Pvm Accounting Fundamentals Explained

Wiki Article

Excitement About Pvm Accounting

Table of ContentsHow Pvm Accounting can Save You Time, Stress, and Money.6 Simple Techniques For Pvm AccountingHow Pvm Accounting can Save You Time, Stress, and Money.The Basic Principles Of Pvm Accounting Pvm Accounting Can Be Fun For AnyoneSee This Report on Pvm Accounting

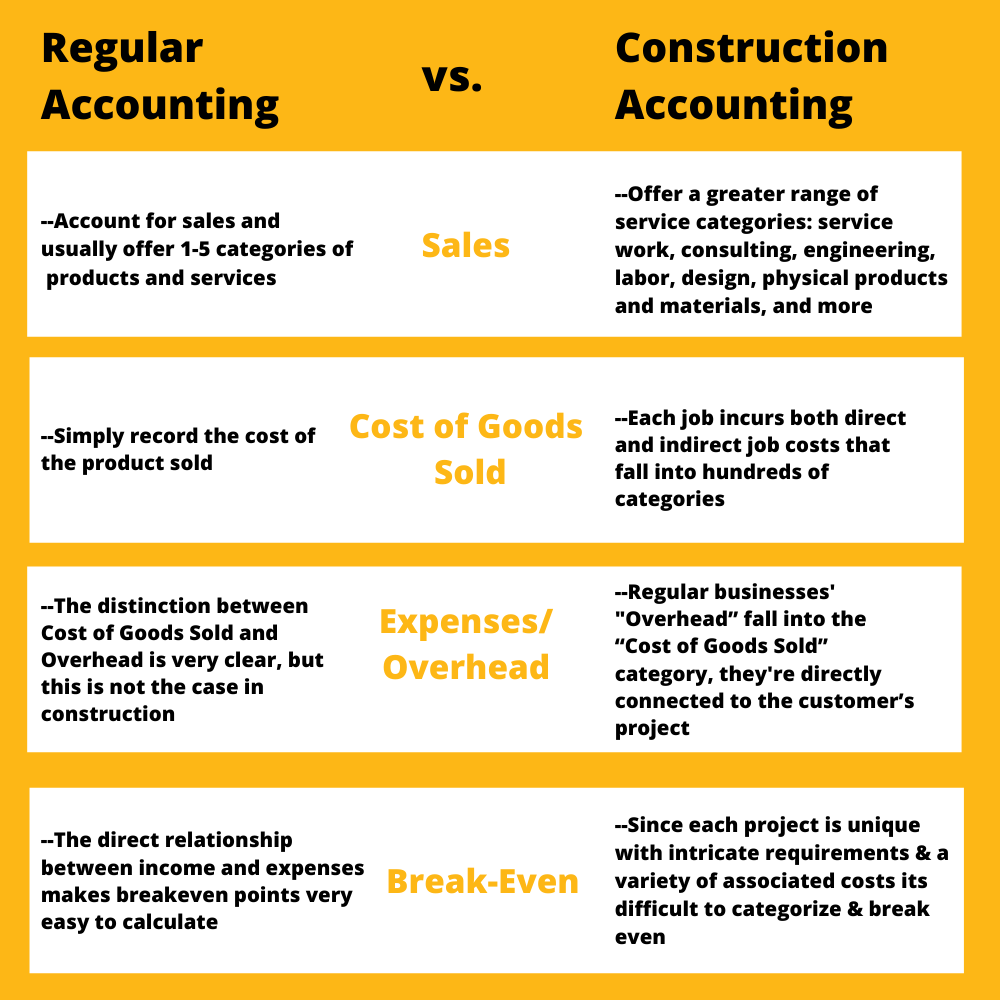

Coverage straight to the CFO, this person will certainly have full ownership of the bookkeeping function for 3 entities, while handling a group of 3+ individuals. It features trainer Joann Hillenbrand, CCIFP that currently offers as the Principal Financial Police Officer for Airco Mechanical, Integrated. Joann has even more than 30 years of experience in building and construction audit and shows students a selection of abilities, including: contract administration bookkeeping cash money management economic declaration monitoring construction accounting principles building and construction threat monitoring fundamentals (consisting of insurance policy) The training course costs $865 to get involved in.Instead, companies commonly need degrees and experience (i.e. permanent employment or internships). Building accounting professionals supervise financials on jobs and for their business overall. Responsibilities include: planning/coordinating task financials overseeing numerous kinds of economic evaluation (i.e. task cost price quotes) assessing financial files (i.e. invoices, contracts, etc) monitoring costs and earnings analyzing (and determining methods to address) economic dangers, both on specific tasks and those affecting the company in its entirety preparing and sending monetary records, both to stakeholders and relevant governing bodies To become a building accounting professional, an individual should generally have a bachelor's level in an accounting-related area.

Unknown Facts About Pvm Accounting

Find out more regarding Bridgit Bench, a workforce preparation application constructed to assist building and construction experts (including construction accountants) manage various aspects of their job extra successfully. Michel Richer is the Manager of Web Content and Product Marketing at Bridgit. He began in the building and construction market at an early stage with a neighborhood reconstruction business.

A building and construction accountant prepares economic statements, checks expenses and spending plans, and collaborates with task supervisors and partners to make certain that the companys financial requirements are met. A building accounting professional works as part of the accounting division, which is in charge of generating economic reports and analyses. Building accounting professionals might also help with pay-roll, which is a kind of bookkeeping.

6 Simple Techniques For Pvm Accounting

Proactively addressing cost and functional relevant matters with job managers, possession supervisors, and other interior job stakeholders daily. Partnering with inner project monitoring groups to ensure the economic success of the firm's growth projects making use of the Yardi Work Expense component, including establishing up jobs (tasks), budget plans, agreements, modification orders, order, and handling billings.

Ability to prepare reports and organization communication. Capability to properly existing info and react to inquiries from teams of managers and straight and/or professional workers. Digital Realty brings companies and data together by delivering the full spectrum of information center, colocation and interconnection solutions. PlatformDIGITAL, the business's international data facility system, gives customers with a secure information meeting area and a proven Pervasive Datacenter Style (PDx) option approach for powering technology and successfully handling Information Gravity difficulties.

5 Easy Facts About Pvm Accounting Described

In the early stages of a building and construction service, business owner most likely manages the building and construction accounting. They manage their own books, care for balance dues (A/R) and payable (A/P), and manage payroll. As a construction business and listing of tasks expands, nonetheless, making economic decisions will reach beyond the role of a bachelor.For numerous months, or perhaps a couple of years, Bob performs every one of the necessary audit tasks, lots of from the cab of his truck. https://www.goodreads.com/user/show/178444656-leonel-centeno. He manages the capital, obtains brand-new credit lines, chases after down unsettled billings, and puts all of it right into a solitary Excel spread sheet - construction bookkeeping. As time takes place, they recognize that they barely have time to handle new projects

Soon, Sally ends up being the permanent accountant. When receivables hits 6 figures, Sally understands she can not keep up. Stephanie signs up with the audit group as the controller, ensuring they're able to stay on top of the building projects in six different states Determining when your building and construction business awaits each duty isn't cut-and-dry.

Not known Details About Pvm Accounting

You'll need to determine which duty(s) your company needs, relying on financial needs and firm breadth. Right here's a break down of the common duties for each role in a building company, and exactly how they can improve your payment process. Office managers wear A great deal of hats, particularly in a tiny or mid-sized construction company.

$1m $5m in annual income A controller is typically in fee of the accountancy division. A controller might establish up the accountancy division (financial reports).

The building controller is in fee of producing exact job-cost accountancy records, taking part in audits and click for info preparing reports for regulators. Additionally, the controller is in charge of ensuring your business abide by monetary coverage regulations and regulations. They're also needed for budgeting and tracking yearly efficiency in connection with the yearly budget.

Fascination About Pvm Accounting

Report this wiki page